Biofuels go global

Sponsored feature: SCB & Associates

Biofuels have come of age as a sizeable and integrated part of the world’s energy mix. Mature biofuels support programmes in the US and Europe that are aimed at cutting carbon emissions and increasing energy independence led global biofuels output to reach more than 1.3 million barrels per day in 2013. This makes biofuels as large a contributor to global energy supply as mid-ranking Opec members Libya or Algeria. Ethanol now delivers around 10% of the entire US gasoline supply, while the European Union is targeting a 10% share for renewables in road transport fuel by 2020. Governments in parts of Asia and Latin America are stoking double-digit demand growth to achieve the same emissions reduction and security of supply goals as US and European governments.

Manufactured largely from agricultural commodities but consumed in the traditional fuel supply chain, biofuels prices are driven by the complicated interplay between crude oil and agricultural fundamentals. Policy changes regarding specific regional biofuel support structures represent another ever-shifting fundamental.

This mix creates a complicated trading and hedging proposition for the agricultural and biofuel producers, oil companies, trading houses and banks involved in the well-to-wheel biofuels supply chain. With both producers and consumers spanning the globe from Latin America to Asia, arbitrage opportunities for achieving supply/demand efficiencies are plentiful.

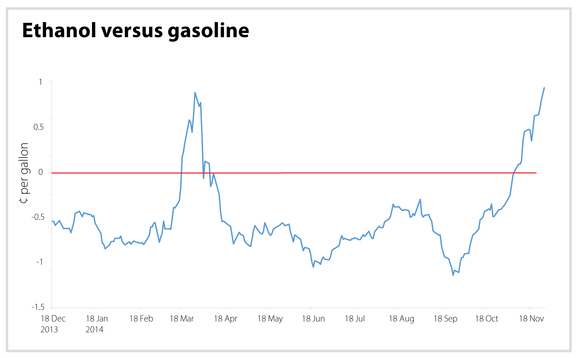

Sizeable discounts relative to conventional fossil fuel prices in 2014 for the corn, palm fruit and oilseeds needed to manufacture most ethanol and biodiesel lifted oil company demand for cheap biofuels to use as a blendstock, without any help from government support schemes. With agricultural yields and acreage trending higher each year, so-called ‘discretionary biofuel blending’ looks likely to become more prevalent in future as global oil products consumption continues to climb.

Crossing continents

Understanding the regional policies and dynamics underpinning trade in physical and listed biofuels products is key to providing customers with the market overview they need to trade effectively. As well as providing a dedicated regional focus, SCB’s brokerage offices in Europe, the US and Singapore give its eclectic customer base broader global visibility of the risk management needs and trading opportunities available to counterparties operating across regions. SCB’s research arm packages the firm’s wide-ranging trade-generated market data into accessible bespoke analysis and tools to better inform customers’ trading needs.

In 2014, SCB’s teams of physical brokers in Singapore, Europe and the US helped deliver Malaysian and Indonesian palm-based biodiesel and Argentinian soy-based biodiesel to destinations in Asia, Europe, the Middle East Gulf, west Africa and the US. Brokers have co-ordinated deals for Brazilian ethanol into the huge US domestic market, as well as from the US to South-east Asian export destinations. EU biofuels policy, meanwhile, is starting to fold biofuels trade into existing emissions trading schemes. SCB brokers have been at the forefront of navigating customers through Europe’s patchwork of markets as they adjust to new mandatory standards aimed at achieving international carbon reduction targets.

SCB’s US and European swaps desks facilitate execution and price discovery in the world’s largest markets for listed biofuel derivatives and blending obligation tickets. Desks covering listed agricultural and energy products allow customers to access the futures instruments needed to hedge market risk alongside their physical and over-the-counter swaps portfolios. And SCB remains at the forefront of the development of new hedging instruments, with SCB’s Singapore office instrumental in establishing CME Group’s new dollar-denominated swaps in palm oil and olein, aimed at international firms exposed to the growing South-east Asian palm oil market.

Although a relative newcomer to the world energy stage, the biofuels industry is evolving rapidly. Commercial technologies to convert waste biomass into high-quality, environmentally friendly liquid fuels will drive the next step change in market structure. SCB will continue to provide its customers with the market insight and understanding needed to succeed in this fast-changing but fascinating environment.

More on Energy transition

CRO interview: Brett Humphreys

Brett Humphreys is head of risk management at environmental markets specialist Karbone. He talks to Energy Risk about the challenges of modelling outcomes in unpredictable times and how he’s approaching the risks at the top of his risk register

High risk and volatility require new risk management approaches

Energy leaders warn fast-rising geopolitical, market and infrastructure risks demand new strategies, AI adoption and stronger risk culture

Uncertainty causes rethink on clean energy investment

Waning enthusiasm for net-zero pledges, environmental policy shifts, funding cuts and US tariffs are causing clean energy investors to retreat

Data and analytics firm of the year: LSEG Data & Analytics

Energy Risk Awards 2025: Firm’s vast datasets and unique analytics deliver actionable insights into energy transition trends

Sustainable fuels house of the year: Anew Climate

Energy Risk awards 2025: Environmental firm guides clients through regulatory flux

Corporates keep the faith on net-zero goal

Large corporates’ energy transition includes trading and risk management in energy and commodities markets

Environmental products house of the year: ENGIE

Renewable energy and the liberalisation of power markets in Apac present significant long-term growth opportunities, with ENGIE driving change in energy transition

ENGIE empowers clients globally to decarbonise and address the energy transition

In recent months, energy market participants have faced extreme volatility, soaring energy prices and supply disruptions following Russia’s 2022 invasion of Ukraine. At the same time, they have needed to identify and mitigate the longer-term risks of the…