Risk Staff

Follow Risk

Articles by Risk Staff

Mark-to-market accounting revisited

New risk disclosure and valuation regulations are aiming to revive energy trading in the US, but cumbersome accounting rules may put companies off hedging altogether, finds Catherine Lacoursière

Prices stable in market turmoil

Given the major changes taking place in the energy trading sector at present – and in view of recent events – it is not surprising that prices are behaving very differently from those last year. Eric Fishhaut of GlobalView Software gives an appraisal

LNG: handling flexibility risk

Even though the euphoria about the global liquefied natural gas market has dissipated, experts still forecast significant long-term growth. But in a buyer’s market the supplier has to understand the new risks. Maria Kielmas reports

Looking to the long term

After years of public debate, the European Commission, energy companies and governments of gas-producing countries all seem to agree that long-term gas contracts are here to stay. So why is it still such a big issue, asks Maria Kielmas

Gas storage and power prices: inextricably linked

While much has been made of the effect of natural gas storage on gas prices, very little thought has been given to its impact on the price of electricity. John Hopper, president of Falcon Gas Storage Company, analyses the situation

Clearer waters for ratings

Despite a credit ratings crisis in the energy markets, the prognosis for natural gas companies looks stable, finds Shifa Rahman

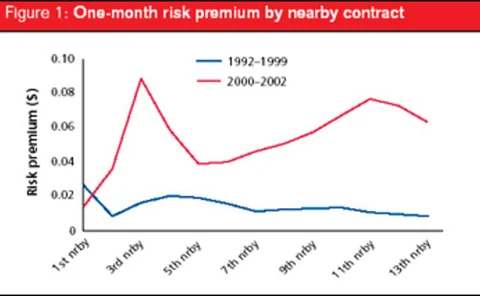

How to gain from risk premia

Brett Humphreys examines historic data for the natural gas market and finds smart traders could make money from hidden risk premia

The rise of the money men

Wanted: company to trade power in the US. Strong credit, trading expertise and appetite for risk required. Only banks need apply? By Kevin Foster

Clear in present danger

Energy companies are crying out for clearing solutions to reduce their counterparty credit risk. James Ockenden looks at new initiatives from London-based power exchange UKPX and German firm Clearing Bank Hannover

Out of the zone: nodal pricing takes hold

Congestion-constrained US electricity markets are likely to find relief with the arrival of a new pricing regime, reports Catherine Lacoursière

Balancing the books

Regulators are taking advantage of a lull in power project development in the US to close loopholes in financing rules, reports Catherine Lacoursière

Through the looking glass

Unlike oil and natural gas, electricity generally suffers poor price transparency. Rachel Jacobson of FAME Information Services looks at power price discovery mechanisms in the US

Managing risk under SMD

Scott Greene, Mark Niehaus and Pankaj Sahay examine the impact of Ferc’s proposed standard market design on power risk management

Estimating oil price volatility: a Garch model

Nikolai Sidorenko, Michael Baron and Michael Rosenberg present a general framework for modelling energy price volatility. These models explain the volatility persistence and clustering present in many commodity prices. In addition, they can incorporate…