Speculation

Q&A: Kaha Kiknavelidze, managing partner at hedge fund Rioni Capital

With the oil & gas industry going through major changes from pricing to regulation, Lianna Brinded talks to Kaha Kiknavelidze of Rioni Capital about oil & gas opportunities

Time runs out for position limits comments

CFTC’s latest position limits plan attracts thousands of comments; opinion deeply divided; new commissioner to affect final vote

Experts discuss need for commodity speculation

Squeezing out speculative capital will affect commodity market liquidity, regulator must engage with market to prevent unintended consequences

CFTC mulls position limits rule, delays vote

US regulator fails to vote on position limits proposal; questions raised about data availability

IEA: Derivatives not to blame for oil's strength

The International Energy Agency (IEA) says that supply and demand fundamentals are to blame for oil price strength, not speculative derivatives products

Q&A – Standard Chartered Bank’s Afaq Khan

Commodities derivatives are used in the West for speculative trading as well as a hedging method to cover commercial risk. Lianna Brinded looks at sharia-compliant products and their role in energy and commodity risk management

Uncertainty over CFTC position limits

A new position limits regime for energy trading in the US could have a significant impact on the sector. Pauline McCallion examines the proposals and finds out about the potential implications for energy players

EXCLUSIVE VIDEO: Shell Energy chief on market challenges

Mark Quartermain, president of Shell Energy North America (US) talks exclusively to Lianna Brinded about major market challenges in oil, gas and carbon markets.

CFTC data shows speculators don't influence commodity markets

The US Commodity Futures Trading Commission’s (CFTC) re-aggregated data releases show speculation has minimal impact on oil price movements, according to investment bank Credit Agricole.

Trading with a small ‘t’

What made headlines before is now becoming everyday news: energy companies are scaling back or leaving energy trading. Some industry observers are emphasising the shift to ‘trading around assets’. Anne Ku investigates just what this means

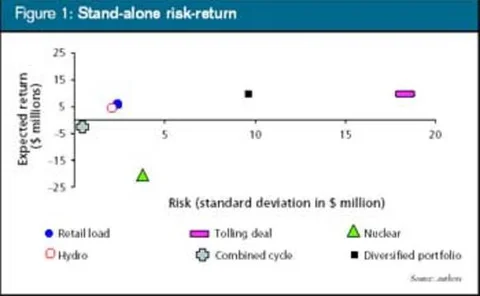

Optimise this

One of the reactions to recent energy trading difficulties has been a shift away from speculative activities towards portfolio optimisation, but what does the term really mean, ask Tim Essaye and Brett Humphreys