Policy risk

Q&A – CFTC's Scott O'Malia

CFTC Commissioner Scott O’Malia shares his views with Ned Molloy on, amongst other things, systemic risk, position limits, the use of non-cash collateral and the jurisdictions of the CFTC and FERC

Commodities Trading and Investment Summit: conference highlights

China, oil prices and the impact of regulation were among the topics hotly debated at Energy Risk’s inaugural Commodities Trading and Investment Summit held in Geneva last month. Ned Molloy reports

Profile: Anthony Belchambers – CEO, FOA

Derivatives regulation needs to better recognise that sustainable economic growth is risk dependent, says Anthony Belchambers, chief executive of the Futures and Options Association. A disproportionate regulatory response with unrealistic goals will…

Jean-Marc Bonnefous talks China and QE2

Jean-Marc Bonnefous, managing partner, Tellurian Capital Management, talks Chinese growth scenarios, quantitative easing, and their impact on commodity markets

California carbon scheme delay “prudent”: EDF

California's decision to delay carbon trading compliance until 2013 “will give the cap-and-trade programme it’s best chance of success”, says AB 32 co-sponsor

Energy experts eye Dodd-Frank tech benefits

Data reporting systems may be far from Dodd-Frank friendly in the energy sector, but experts say users are likely to benefit once they are up and running

Dodd-Frank ready? Structure's Huxtable

More than 75% of energy companies are in “wait-and-see” mode or still assessing how Dodd-Frank regulation will affect their business, according to The Structure Group's Leonard Huxtable

US gas, nuclear outlook: EEI's Infante

The Edison Electric Institute’s Lola Infante discusses risks currently facing the US utility sector, including the potential impact of environmental concerns on natural gas prices and the outlook for nuclear power in the US

CFTC to provide Dodd-Frank deadline exemptions today

Dodd-Frank deadline exemptions should limit market disruption, but more clarity on rules and timings needed, says CFTC commissioner Scott O’Malia

Position limits will feed risk into real economy, say energy companies

Energy market participants have expressed doubt that European position limits proposals will achieve reductions in market volatility, and warned of unintended consequences for end-users' risk management

Carbon price of €60/ton needed to hit targets say traders

Carbon brokers estimate that €60 per European Allowance (EUA) will be needed in the third phase of the Kyoto protocol if the 80% emissions reduction target is to be met by 2050.

European power: the future of interconnectors

Ilesh Patel discusses current regulatory, market and financing challenges to international electricity trade, and proposes a plan of action for regulators and actors in the market

Energy Risk USA - 2011 conference highlights

The 2011 Energy Risk USA conference in Houston provided the chance to interact with industry peers and hear about the latest energy market developments.Ned Molloy and Pauline McCallion report

Dodd-Frank: Summary of rule-making progress so far

As regulators approach the end of the Dodd-Frank rule-making period, Energy Risk details the proposals so far and considers what lies ahead for the new regulatory regime. By Peter Madigan with additional reporting by Pauline McCallion

Dodd-Frank puts market manipulation on the radar

Dodd-Frank regulation could usher in more market manipulation cases such as the recent CFTC case against Arcadia Petroleum, Arcadia Energy and Parnon Energy, say market experts

Energy Risk USA: could anti-manipulation rule curb energy activity?

Dodd-Frank manipulation rules could “chill” energy market and boost regulatory infrastructure costs: ER USA panel

Energy companies warned on end-user status

Energy Risk USA speakers concerned about reliance on end-user status; urge energy companies to begin Dodd-Frank compliance planning

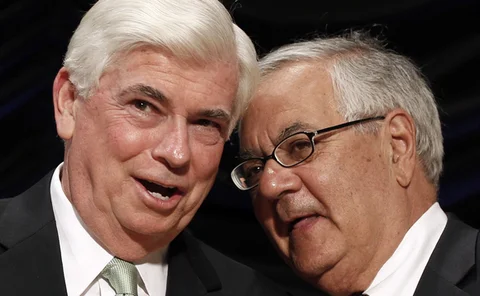

Will ruling create agreement on regulatory jurisdiction?

The FERC’s $30m fine for former a Amaranth trader has set a strong precedent for market manipulation cases, but regulatory overall jurisdiction remains unclear. Pauline McCallion reports

US energy speculation investigation begins anew

The latest effort by the US government to investigate the impact of speculation on oil prices has been met with cynicism by market participants. Pauline McCallion reports

Sponsored Q&A: Accenture Risk Management

The Federal Energy Regulatory Commission (FERC) Orders will dictate change in the wholesale electricity markets this year, requiring all regional transmission organisations, independent system operators and participants to respond. Executive Director at…

CFTC regulators favour extending Dodd-Frank comment period

CFTC cost and timing concerns continue; FTRs and commodity forwards exempted from swaps definition

UK carbon floor seen raising power prices across Europe

Electricity prices could rise as the UK sets a minimum floor price for carbon

Widespread unease over planned position limits rules

Reservations remain among firms involved in commodity trading about a new position limits regime that could be implemented under the Dodd-Frank Wall Street Reform Act, while support continues from anti-speculation campaigners

Position limits deluge continues

Group bombards CFTC with comments on Dodd-Frank position limits; final rule delay expected; quantity unlikely to trump quality says expert