Options

Podcast: Kaminski and Ronn on negative oil and options pricing

The market is gravitating to the Bachelier model as an alternative to Black 76

CFTC’s Massad woos energy firms with Dodd-Frank fixes

US Commodity Futures Trading Commission chairman Timothy Massad stresses the agency will smooth out flaws in the agency's Dodd-Frank Act rules, but sidesteps a question over whether they were rushed

CFTC's Wetjen urges fix to commodity options problem

CFTC commissioner says seven-part test on definition of a swap under Dodd-Frank "was not specific enough or clear enough" for industry participants

CFTC close to fixing Dodd-Frank commodity option woes

The Commodity Futures Trading Commission is said to be exploring solutions for the so-called 'seventh prong' problem created by its definition of a swap under the Dodd-Frank Act

Ethics and moral standards are as crucial to finance as ever

Despite the twists and turns of history, some things remain the same – an important lesson that can be found in the work of Émile Zola. His novel L’Argent shows how an erosion of moral standards can be lethal to individuals, the institutions they run,…

Deal of the Year: BP

Moving quickly, BP managed to salvage Iona Energy’s North Sea acquisition with an innovative crude oil options transaction

Energy firms beg CFTC for clarity on commodity options

Utilities, oil producers and trading firms are urging the CFTC to issue clarification on contracts with embedded volumetric optionality

Classic cutting edge: Swing options and the quest for valuation

Energy Risk presents a classic paper on swing options pricing by Patrick Jaillet, Ehud Ronn and Stathis Tompaidis, which was first published in 1998. It introduced the so-called binomial forest method, which was influential in the development of pricing…

Oil market faces tight deadline for Ice Brent protocol

As Ice prepares to shift Brent expiry calendar on December 6, Isda releases protocol to enable orderly transition of OTC market

Ice bows to pressure on Brent contract changes

Exchange delays plan to shift expiry calendar for Brent crude oil futures and options after firms complain they need more time to prepare

Brent options trading disrupted by Ice expiry date shift

Proposals to ensure convergence between futures and physical Brent cause firms to avoid trading long-dated options

Asia Commodity Derivatives House of the Year: Deutsche Bank

Despite cutbacks in Europe and the US, Deutsche Bank’s Asia commodities franchise continues to impress

Cutting edge: Impact of execution behaviour on valuation of optional financial contracts

Expected payoff maximisation is a commonly assumed strategy in valuation. S Hossein Hosseini, Qiaoyan Bian, Jay Chen and John Jiang suggest that execution strategies may vary due to complex option structures and their resulting uncertainties. Using a…

Cutting edge: Minimising risk when hedging crude oil options

In this paper, Christian-Oliver Ewald, Roy Nawar and Tak Kuen Siu study the performance of locally risk-minimising hedging strategies in the context of futures and options written on crude oil. In contradiction to prior research, the authors show it is…

Mexico driving put skew in Brent, say brokers

The put skew in Brent crude oil is close to its yearly high. This is being driven by the hedging programme of Mexico, as well as more general risk aversion on macroeconomic worries, according to brokers

Algorithmic trading in energy

Algorithmic trading has made slow progress in energy markets. Ned Molloy looks at the reasons for the limited uptake and at the market’s prospects

Cutting edge technical: Carbon derivatives pricing

In carbon dioxide equilibrium models, permit prices are positive and bounded by the penalty level. To obtain closed-form solutions to the pricing of carbon dioxide derivatives, Daniel Bloch models the permit price as a function of a positive unbounded…

Henry Hub futures activity surges

Volume in Nymex’s benchmark Henry Hub natural gas contract exceeds 500,000 contracts for first time

Qantas’s head of risk: hedging programme is too conservative

Qantas Airways’ head of risk believes the company could take more risks within its hedging programme

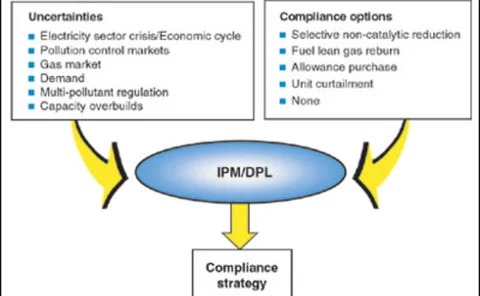

Not just a quick fix

Real options are an accepted risk management technique in the energy sector. Kevin Foster takes a look at how are they being used and what factors are affecting their development and implementation