Commodity derivatives

Q&A: Tony Hall at Duet Commodities Fund

After turning one of the highest proprietary trading profits in the history of Credit Suisse Commodities in 2009, Tony Hall launched hedge fund Duet Commodities Fund last year. He will be delivering the keynote talk at Energy Risk’s Commodities and…

Valuing non-standard load profile products

Load profile products in the European OTC power markets are attracting increasing attention. However, valuations for these non-standard products can be difficult, as Cregor Janssen and Jan Lueddeke discuss

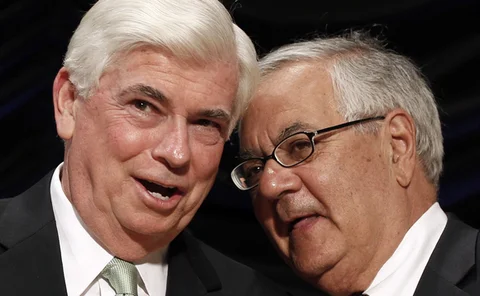

Widespread unease over planned position limits rules

Reservations remain among firms involved in commodity trading about a new position limits regime that could be implemented under the Dodd-Frank Wall Street Reform Act, while support continues from anti-speculation campaigners

Special report – Weighing up Dodd-Frank

What will impending regulation under the Dodd-Frank Act mean for the energy sector? Our US editor, Pauline McCallion puts the question to leading industry participants

Energy Risk Glossary 2011

The Energy Risk Glossary: the most comprehensive reference source for anyone involved in the global energy markets

US renewable energy: A carrot and stick approach

Pauline McCallion examines current risks surrounding the development of renewable energy resources in the US

CME slams potentially stricter position limit rules

CME Group chief executive slams proposed position limit regulations as “unnecessary”

Concerns over Egypt & inflation push oil derivatives trading volumes to record levels

Oil prices will continue to rise to triple-digit highs over 2011 on long-term Egypt risk premiums and continual unrelated underlying issues, say market experts

Oil to reach over $150/bbl in 12-18 months

A prominent hedge fund manager says oil price will break through historic highs within the next 12-18 months

CFTC presses on with position limits proposal

Concerns remain over position limits for commodity traders under Dodd-Frank Act as CFTC issues plan for public comment

Commodities remain an attractive asset for hedge funds

Despite volatile markets, commodities trading remains a popular strategy for hedge fund managers and investors as regulators target speculation. Joanne Harris reports

Q&A: Marc Fontaine, head of commodity derivatives, Americas at BNP Paribas

Marc Fontaine, head of commodity derivatives, Americas at BNP Paribas talks to Pauline McCallion about addressing energy end-user needs in light of the Dodd-Frank Act and recruiting new talent to the sector.

Turning Points: James Emanuel, ADM Investor Services International

James Emanuel, head of environmental markets at Archer Daniels Midland subsidiary ADM Investor Services International, talks to Alex Davis about the complexities of the carbon markets

CME’s CCP to clear Middle East products and reduce 'black swans'

Clearport courts emerging market derivative exchange products in a bid to reduce systemic risk in commodity markets

Sponsored Q&A: BNP Paribas

Speaking at Energy Risk Asia, BNP Paribas’ head of Commodity Derivatives for Asia Pacific, Frederic Hervouet, discussed hedging strategies, products and commodity exposure at mining and resource companies

Turning Points: Thomas McMahon, CEO Singapore Mercantile Exchange

The Singapore Mercantile Exchange’s chief executive Thomas McMahon tells Alex Davis about the lure of the trading floor and the events that have shaped his approach to risk

Singapore conference report

Energy risk managers, end-users and producers from across Asia gathered for Energy Risk’s annual conference in Singapore in September to discuss how energy and commodities markets will evolve and face the challenges that lay ahead. Lianna Brinded reports

EDF’s head of credit risk: misconceptions of assessing credit

EDF Trading North America’s head of credit risk talks to Lianna Brinded exclusively about the misconceptions of assessing credit risk in the energy and commodities market

Analyst: unified framework is better for energy risk management

Building a unified framework for consistent modelling of energy spots, forwards and swaps is better for energy risk management, says Verbund Austrian Power Trading’s principal quantitative analyst

CROs facing new challenges and regulations

The role of chief risk officers (CROs) and risk management have become even more important for energy companies as they face rapidly changing markets and regulations

Video: Interview of Natixis's Asia-Pacific energy chief

Charles Maulino, head of global energy & commodities coverage, Asia-Pacific at Natixis, speaks exclusively with Lianna Brinded about the evolution of energy and commodities financing and hedging strategies

Video: Isda Asia-Pacific chief says new regulations 'potentially dangerous'

Keith Noyes, Asia-Pacific regional director at the International Swaps and Derivatives Association (Isda), speaks to Lianna Brinded about regulatory changes and the impact they will have on the energy and commodities markets.

Video: Chairman of the Hong Kong Mercantile Exchange

Barry Cheung, chairman at the Hong Kong Mercantile Exchange, speaks to Lianna Brinded about the liberalisation of China's renminbi and the positive effects it will have on energy and commodities.

Evolving risks require new answers

The methods Asian energy and commodities companies use to finance and hedge projects have merged, says Natixis’s Asia-Pacific energy and commodities chief