Clearing

Reform bill passes Ag Committee before full Senate debate

The US Senate Committee on Agriculture, Nutrition and Forestry has approved the Wall Street Transparency and Accountability Act, containing some of the strongest derivatives reforms proposed since the financial crisis.

Ice receives CFTC clearing registration

IntercontinentalExchange (Ice) has been granted limited registration by the Commodity Futures Trading Commission (CFTC) as a US derivatives clearing organisation (DCO).

Nodal Exchange offers first real-time LMP contracts

Nodal Exchange launched eight contracts today, its first to settle against real-time Locational Marginal Price (LMP).

In the clear

The trend away from uncleared over-the-counter trading to cleared OTC trading has prompted exchanges to list a greater range of OTC cleared products. But to what extent can the OTC markets ever become completely cleared? Katie Holliday investigates

All Clear?

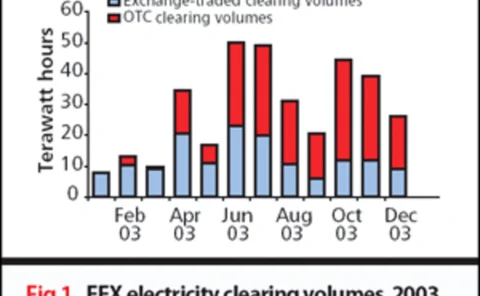

Despite a recent large increase in volumes, clearing for commodities remains a contentious issue, with little agreement on what the best business model should be, and insufficient standardisation, say market participants. Rachel Morison investigates

European Commissioner backs power exchange merger

EU energy commissioner Andris Piebalgs has backed the merger of Germany’s European Energy Exchange (EEX) and France’s Powernext to create single Franco-German power spot and futures markets.

War of words escalates in Cbot battle

A week after IntercontinentalExchange (ICE) announced its audacious $10 billion attempt to prise the Chicago Board of Trade from their grip, Chicago Mercantile Exchange executives gathered in Chicago to pour scorn on the proposal.

ICE proposes $10 billion merger with CBOT

The IntercontinentalExchange (ICE) has made a proposal to the Chicago Board of Trade to combine the two companies in a stock-for-stock transaction that would create the world’s most comprehensive derivatives exchange, ICE announced today.

CME, CBOT to merge

The Chicago Mercantile Exchange is to merge with the Chicago Board of Trade in a move the exchanges say is “expected to transform global derivatives markets.”

Clearing service launches for physical power in US

North American Energy Credit and Clearing (NECC), the Clearing Corporation (CCorp) and Atlanta-based commodity-trading platform IntercontinentalExchange (Ice) have launched a physical clearing service for the US energy markets.

IPE members approved to trade on Ice OTC markets

The International Petroleum Exchange’s (IPE) registered brokers and local traders can now trade on IntercontinentalExchange’s (Ice) over-the-counter markets for their own accounts.

LCH Clearnet launches OTC clearing for UK gas and power

London-based clearing house LCH Clearnet today launched its new clearing service for over-the-counter (OTC) contracts for UK national balancing point natural gas and UK peak and baseload power contracts.

LCH Clearnet set to clear US trades

LCH Clearnet, Europe's largest derivatives clearing house, has won approval from the US Commodity Futures Trading Commission to clear financial futures and options contracts on US exchanges.

Taking the slow road

Recent developments suggest that clearing is likely to gain widespread acceptance in the European energy market. Market participants feel it is a question of how and when – not if – robust, liquid solutions will emerge. By Joe Marsh

Measuring the value of clearing

Central clearing houses offer major advantages to the electricity trading industry, says UK Power Exchange’s Paul Danielsen. He sets out a practical example to demonstrate how UK power firms can benefit from clearing

The case for financially settled contracts

Banks and hedge funds have shied away from trading electricity due to fear and ignorance of the physical nature of the market. But, as Todd Bessemer of Accenture points out, financially settled contracts can avoid the complexity of physical delivery and…

Online clearing: the shape of energy markets to come

The energy trading market is moving towards a structure in which participants achieve market presence through a dedicated market network, rather than having to use local or regional exchanges, says strategic consultant Chris Cook

US retreat hits European trading

The retreat of US energy firms from energy trading has reportedly hit European volumes hard. But volumes aside, James Ockenden finds that the withdrawal may bring a fundamental change in the market. With additional reporting by Eurof Thomas

Margin notes

Brett Humphreys explains how to measure and manage margin risk, an often-overlooked – yet often-significant – risk exposure

Clear in present danger

Energy companies are crying out for clearing solutions to reduce their counterparty credit risk. James Ockenden looks at new initiatives from London-based power exchange UKPX and German firm Clearing Bank Hannover