Value-at-risk (VAR)

Better risk reporting doesn’t need an IT upgrade

By revisiting certain calculations, new insights into risk and profit drivers can be gained, says data scientist

Practitioners must take risk measures with a pinch of salt

While useful, it is possible to rely too heavily on conventional risk measures such as volatility and value-at-risk – a point made recently by billionaire US investor Warren Buffett. Every aspiring practitioner should know about their drawbacks, writes…

Goldman and Citi defy gravity on commodity VAR

Commodity VAR at Citi and Goldman Sachs stays about the same or increases from 2012–2014, as other major dealers pare back

Applied risk management series: Active VAR management

In this article, Carlos Blanco introduces a set of tools to assist traders and risk managers in actively managing the value-at-risk of energy derivatives portfolios

Resist the rise of the risk management machines

Overreliance on modern risk management systems, and metrics such as value-at-risk, can blind firms to tectonic structural market shifts. To help alleviate this problem, the use of human judgement and intervention is required, argues Vincent Kaminski

Applied risk management series: Integrating stress tests with risk management

Stress testing is a vital part of successful risk management, but risk managers at energy trading firms frequently face obstacles in designing and implementing successful stress testing programmes. In this article, Carlos Blanco provides some advice on…

Liquidity forces energy firms to get creative with risk management

In some corners of the over-the-counter energy market, liquidity has become increasingly thin during the past few years. As a result, firms need to think more creatively about how they handle liquidity, say risk managers. Stella Farrington reports

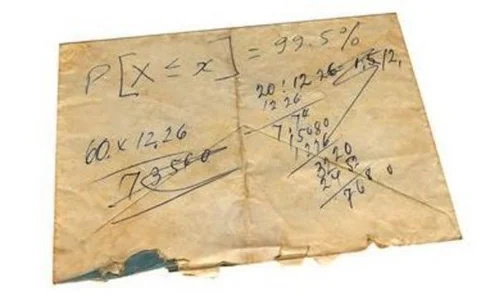

Applied risk management series: Venturing beyond VAR

In this article, Carlos Blanco and José Ramón Aragonés review the historical simulation methodology used to estimate value-at-risk and expected tail loss, while including adjustments to traditional assumptions that can help improve risk forecasts for…

Bank commodity VAR remains muted in Q4

Fourth-quarter results show low risk appetite continues to prevail at banks, reflecting tougher capital requirements and a continuing lack of trading opportunities, writes Jay Maroo

Banks retreat from commodity derivatives

Increasing capital requirements and other regulatory constraints are cutting the headcount and risk-taking ability of banks in commodity and energy derivatives. Might this diminished role pave the way for less regulated participants to take their place?…

Banks cut commodity VAR as regulatory reform bites

Basel capital rules and regulatory reform stymie risk appetite of major banks in commodities

Enterprise-wide risk management: The power of cashflow-based metrics

The risks faced by energy/commodity firms need to be assessed via metrics that allow for longer-term outlooks and incorporate risks from asset-backed trading. In the second article in this series, Chris Strickland discusses the range of such metrics…

How relevant is VAR for energy markets?

Despite its many limitations, value-at-risk (VAR) is still the most commonly used risk profile measuring tool in the energy industry. In this first article in a new series, Chris Strickland discusses why the energy industry’s love affair with VAR could…

Energy Risk Europe 2010

Energy Risk's 2010 annual Europe conference brought leading chief risk officers, quantitative analysts and regulators to London to discuss key risk management issues

Power exchange to launch gas contract

New Nodal Exchange contract to increase options for power traders; anticipates future gas and renewables demand

Regulation, liquidity and risk management strategies

US derivatives regulation is likely to have far-reaching consequences for energy companies, but how will it affect the liquidity risk management strategies developed in the wake of collateral management events of the past decade? Pauline McCallion reports

End-users adopt more complex hedging tools and methods

End-users’ energy and commodities hedging strategies are growing in sophistication as they adopt more complex products and non-traditional tools, says the head of RWE npower’s optimisation desk

Q&A: Blue Star Energy Solutions’ John Wengler on risk

BlueStar Energy Solutions’ chief risk officer, John Wengler, speaks to Pauline McCallion about managing energy risk in the US power markets

Q&A: Endesa’s Jaime Roman on mergers

Jaime Roman, head of risk management at Spanish utility Endesa, talks to Katie Holliday about the attitudes to risk management in Europe from the perspective of a major European utility operating in the growing Iberian markets

Q&A: Mitsubishi UFJ Securities Holdings’s Akihiro Kawabe on transparency

Risk management in Asia is arguably more difficult to estimate as each country has very different regulatory requirements and political risk. Lianna Brinded speaks to Akihiro Kawabe, executive officer and general manager of the corporate risk management…

Exclusive Kaminski Video: energy risk management challenges

The energy markets still face an unprecedented level of regulatory risk over the next year, as impending changes to the US financial system loom, while at the same time, BP’s Gulf of Mexico oil spill has presented major operational risk factors for the…