Counterparty credit risk

Best newcomer, Asia: CubeLogic

Energy Risk Asia awards, 2018: Enterprise risk management software firm brings new tools to Asia market, particularly around credit

Credit risk in energy: Best practices for challenging times

Low prices across the commodity spectrum have made credit risk a higher priority for energy firms worldwide. This webinar, brought to you by Energy Risk and Moody's Analytics, brings together thought leaders from across the industry to discuss the best…

Oil rout sharpens energy companies' focus on credit risk

With defaults in the energy industry at their highest level in 15 years, firms are increasingly nervous about the credit standing of their peers. That has put pressure on credit teams to improve their counterparty assessments

Applied risk management series: Counterparty risk exposure metrics

The use of static counterparty exposure metrics, which provide an incomplete view of the risk of individual deals and portfolios, may lead risk managers to take decisions with unintended consequences. Carlos Blanco outlines a better approach using…

Right-way risk can create a false sense of security

Dealers typically find comfort in right-way correlations between their exposure to energy sector counterparties and the creditworthiness of such companies. While this reasoning is unquestionably correct, it may create a false sense of security, writes…

Energy markets need more than second-hand credit models

In the energy markets, models transplanted from financial markets often fall down when it comes to credit risk. This occurs for a variety of reasons, not least because energy markets are prone to seismic institutional and technological shifts, argues…

Energy market focuses on counterparty risk

The critical importance of counterparty risk management was demonstrated by the bankruptcy of Lehman Brothers in September 2008. In response, banks and other energy market participants have been trying hard to improve their game. Gillian Carr reports

Credit rating agencies: what are the alternatives for energy markets?

Repeated stumbles by the credit rating agencies have led risk managers to explore new ways of assessing counterparties. Alexander Osipovich examines the alternatives

Energy players assess MF Global fallout

MF Global’s bankruptcy is unlikely to significantly impact commodity markets, participants say, but could affect the Dodd-Frank rule-making process

Managing oil and gas delivery risk

For producers and suppliers of oil and gas, the standard industry practice of waiting up to two months for payment represents significant credit risk. Brian Shydlo offers some solutions for measuring and mitigating this delivery risk

The evolving credit function

The role of the credit function at energy companies is likely to change enormously in the coming months. Are companies ready and how will the changes impact the risk management function? Anna Reitman and Pauline McCallion report

Profile: Diana Higgins, Director Crediten

Assessing counterparty credit can require the skills of a private detective, says Diana Higgins, talking to Stella Farrington about her credit risk career and the changing role of the credit function

Collateral management: Firms face up to regulatory challenge

Collateral management has become an increasingly complex and vital component of credit risk management for the energy sector. With the EU considering reforming commodity derivative regulation, Alex Davis looks at the latest developments and examines…

Experts examine US power clearing and netting needs

As the US Congress moves to boost derivatives clearing requirements, an industry panel has called for regulators to investigate a move towards clearing and netting across US power markets and to clarify the legal uncertainty in the area

Energy Risk: What's coming next?

Energy Risk brings you a snapshot of what's moving and shaking the markets with a special look at energy credit.

New approaches to energy credit risk management

The aftermath of the financial crisis led to some innovative approaches to tackling energy credit risk. Pauline McCallion looks at developments and asks whether proposed US and European regulation will help or hinder innovation in this space

Interview: Darrell Duffie on credit risk modelling

Stanford University’s credit risk expert, Darrell Duffie, talks with Katie Holliday about changes in the modelling of credit risk within energy markets since the financial crisis

Mexico sees return to normality for oil hedging

Banks’ ability to act as a counterparty is “back to a very normal situation” after the credit crunch, according to one of the designers of Mexico’s oil price hedging programme.

The credit charge

Brett Humphreys describes a simple method for charging traders for the credit risk embedded in a contract, using an example based on an oil purchase agreement. Such a charge creates proper incentives for traders with regard to credit risk

Measuring the value of clearing

Central clearing houses offer major advantages to the electricity trading industry, says UK Power Exchange’s Paul Danielsen. He sets out a practical example to demonstrate how UK power firms can benefit from clearing

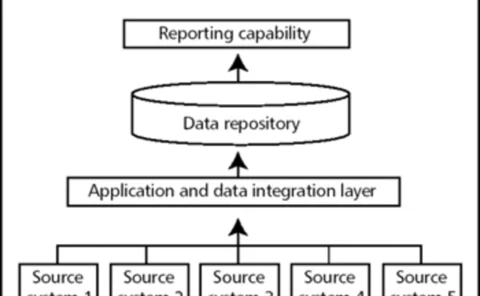

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report